Analaysing the impact of demonitisation on the used car market

We find out the effects of demonitisation on the Indian new and used car market.

Published On Feb 17, 2017 04:29:00 PM

7,058 Views

Follow us on

![]() By Staff Writer

By Staff Writer

The Specified Banknotes withdrawal, better known as demonetization in our parlance, has been the buzzword for over two months now. It has affected sentiments across Industry and the auto sector has not been insulated from this action taken by the government. We at Indianbluebook.com, India’s most trusted vehicle pricing guide, have attempted to understand the impact of this radical step on the used car market. In this study we provide insight on key areas of impact beyond just vehicle pricing. We also look at the impact of demonetization on used car demand and how the industry is expected to recover and what structural shifts we expect over the next twelve months. The used car market is complicated with various participants trading over 3.3 cars annually. The industry is largely unorganized with over 2.8 million cars transacted through semi-organized dealers and brokers or directly between customers. The used car market plays a critical role in the new car industry by enabling over 900,000 trade-ins (exchanged vehicles) at new car dealerships. These trade-ins are essential for new car sales.

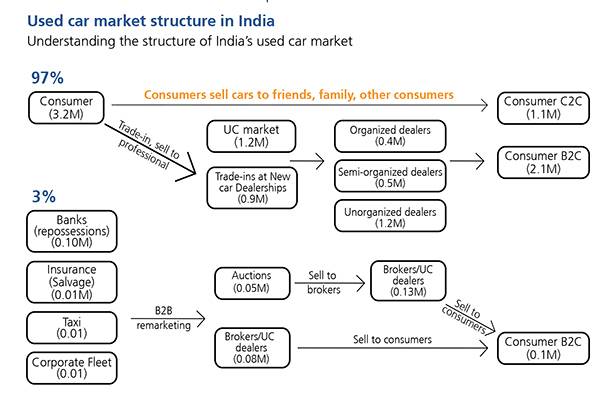

Used car market structure in India Understanding the structure of India’s used car market

The used car market is complicated with various participants trading over 3.3 cars annually. The industry is largely unorganized with over 2.8 million cars transacted through semi-organized dealers and brokers or directly between customers. The used car market plays a critical role in the new car industry by enabling over 900,000 trade-ins (exchanged vehicles) at new car dealerships. These trade-ins are essential for new car sales.

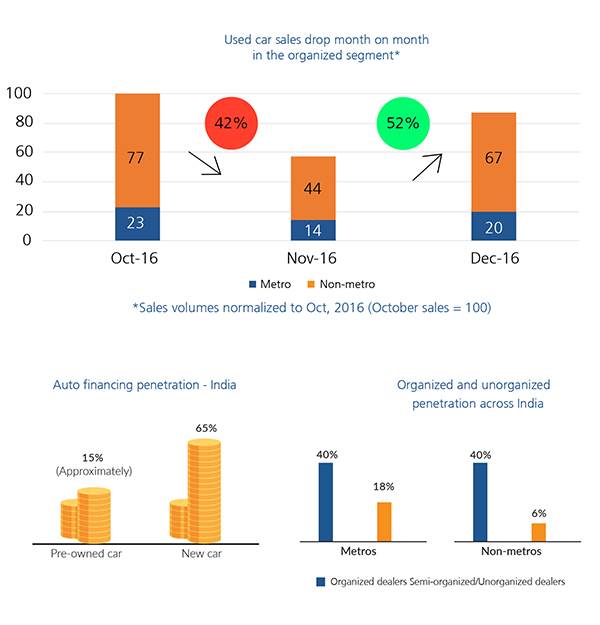

Finance penetration in the used car Industry at 15% significantly lags new car finance penetration, which is currently at 65%. 85% of used vehicles therefore either are purchased with cash or other informal borrowing. Finance penetration in non-metros is even lower. The cash crunch induced by demonetization has led to customers postponing their decision to buy used cars, leading to a fall in volume in November. December has shown some recovery from November. North and Eastern regions of India were more severely

How did the liquidity crunch affect used car demand?

IndianBlueBookIn one of the largest exercises conducted in the country by far, the team at IndianBlueBook reached out to more than 38,000 in-market customers to understand the impact of this economic discontinuity on the consumer purchase cycle and the resulting pent up demand. Data shows a sharp decline of almost 13% in customers intending to complete the car purchase cycle within 30 days as compared to the period from Apr-Oct, 2016. Our analysis shows that customers have postponed the decision to buy. They have other immediate priori-ties to deal with, a car purchase being somewhat discretionary.However, it is important to understand that customers have not abandoned the decision to purchase a car altogether, but it is rather a case of postponement. With fundamental growth drivers of the used car market remaining intact, this pent up demand will get serviced when consumer purchase cycles return in the coming months. We expect further material recovery of volume in January.

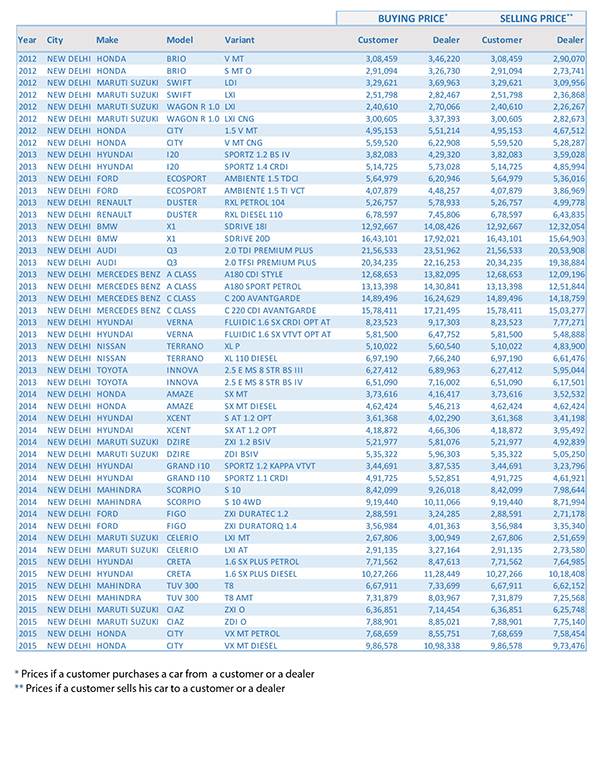

Impact on used car prices

Analyzing the IBB price index, which tracks relative pre-owned vehicle price changes on a monthly basis across India, sheds light on the impact of demonetization

04IndianBlueBookThe IBB index registered a sharp spike in Nov, 2016 before collapsing in the month of Dec, 2016. Typically, November is when the used car prices begin factoring the change for the upcoming year and the price index declines relative to the prior month. Nov, 2014 and Nov, 2015 data confirm this. However, the temporary spike could be attributed to customers rushing in to car showrooms to complete car transactions in the immediate aftermath of demonetization.

So why have prices fallen so sharply in Dec, 2016 as compared to Nov, 2016?

Well, year change has an impact on used car prices but the other major reason is the economic uncertainty and a weaker new car market. Many people tightened their belts and chose to postpone their decision to replace their current cars, leading to a decrease in supply of used cars.On the demand side, 60% of Indian used car customers are first-time car buyers who are extremely susceptible to any macro-economic shocks. They are the first to leave the market during a period of uncertainty, meaning that demonetization has resulted in a decrease in demand for used cars. These movements in supply and demand have led to a new price equilibrium in the used car market.

Furthermore, exchange penetration at new car showrooms has seen a decline on account of the cash crunch faced by the semi-/unorganized dealers who were enabling these transactions.

What next? When will the recovery take place?

A parallel drawn from the United States – To understand economic discontinuity and its impact on used car prices, we looked at what happened in the United States during the height of the recession in 2007-08. The used car index registered a sharp drop in Jan, 2009 and then recovered sharply in the subsequent period. Our outlook for India is along the same lines - we expect a recovery in demand and used car prices in the coming months.

Long-term, we expect to see a change in structure of the used car market:

The organized segment of the used car market will grow faster at the expense of the semi-organized or unorganized market. Finance penetration will increase from 15% at present to 25% in the next 12 months.

To discover car prices for 4000+ car models and variants across 300+ cities, log on to www.indianbluebook.com

IndianBlueBook - India’s most trusted vehicle pricing guide

IndianBlueBook (IBB) is the industry first pricing guide for new and pre-owned vehicle valua-tion in India. With exclusive access to a large number of car transactions that take place every day through different channels, IBB derives scientific and insightful inferences that lead to vehicle price discovery. Whether you’re buying or selling a vehicle, IBB helps you discover its real worth. Through various transactions on different customer-facing and B2B channels, IBB’s analytical engine logically deduces a pricing index which is then used to derive the benchmark market price of any vehicle. In essence, IBB is a one-of-a-kind valuation platform based on rigorous research and pure rationality. It is driven by the sheer passion to demystify the data points of a million transactions, thus ensuring that you never overpay or never undersell. IBB offers a wide array of tools such as Total Cost of Ownership (TCO) and residual value analysis, regularly updated reviews and insights via its blog, and a platform that enables its customers to buy and sell vehicles, thereby serving as a one-stop shop for customers looking to research vehicles.

Any use, including but not limited to the reproduction, distribution, display or transmission of the content of this report is strictly prohibited, unless authorized by IndianBlueBook in writing

Copyright (c) Autocar India. All rights reserved.

Comments

Member Login

Personal Details

No comments yet. Be the first to comment.