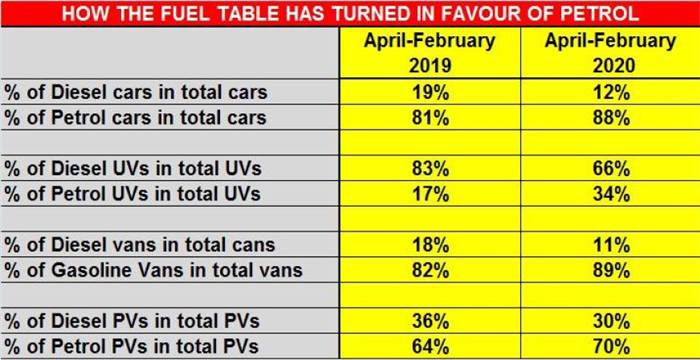

Proof of the marked shift from diesel to petrol-engined vehicles in India can be seen from the latest industry sales statistics. In February 2020, of the total 2,51,516 PVs sold, 14 percent comprised diesel (down from 35 percent in February 2019) and 86 percent were petrol (up 19 percent from 65 percent in February 2019) models.

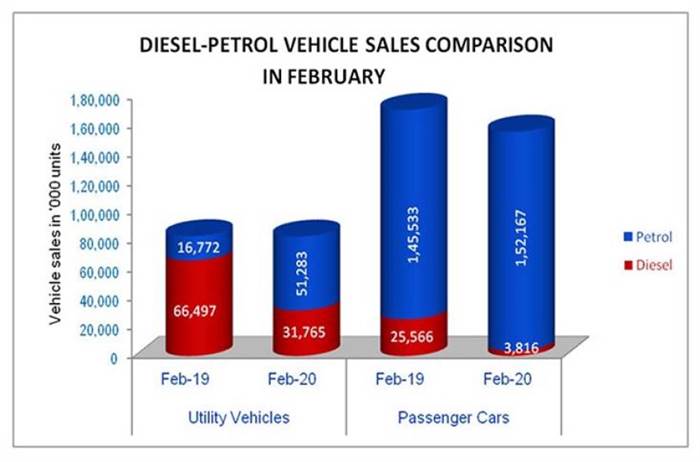

Of the 1,55,983 passenger cars sold last month, 3,816 were diesel and 1,52,167 petrol, making for a 2:98 diesel-to-petrol ratio. Now compare this to the 15:85 ratio of February 2019 and you get an idea of how much consumer preferences have changed over the course of 12 months.

It gets worse in the utility vehicle space. In February 2020, a total of 83,048 UVs were sold, comprising 31,765 diesel and 51,283 petrol which constitutes a 38:62 ratio. Go back a year ago and the consumer shift towards petrol in UVs is an eye-opener – 80:20 diesel (66,497) to petrol (16,772). That's a massive 42 percent shift and indicative of the writing on the wall that OEMs like Maruti Suzuki and Mahindra & Mahindra have seen early in the day.

It must be noted that given their bulky form and built-to-purpose credentials, UVs have traditionally seen a diesel engine get preference over petrol due to its higher fuel efficiency and low-end torque that helps propel these vehicles with ease, even at full load. However, with the narrowing gap between the prices of the two fuels, a 10-year limitation on the life of a diesel vehicle in cities likes Delhi-NCR, and more expensive BS6 diesel engine technology as compared to petrol, the trend is reversing, and how.

Want to know the stats in the van segment? Actually, it's not very different there either. Of the total 11,880 vans sold in February 2020, only 653 (5 percent) are diesels and 11,227 (95 percent) are petrols. Compare this with 18 percent diesel and 82 percent petrol exactly a year ago.

Not exactly good news for diesel in India, is it?

Sub-four-metre and midsize UVs get petrol power pep

Within UVs, the most voluminous sub-segment – the sub-four-metre compact SUVs – is showing a clear shift in buyer preferences. Compact diesel crossovers (less than 4,400mm in length and priced up to Rs 15 lakh) retailed all of 42,200 units in February 2019 against 15,925 units of petrol. This declined to mere 17,343 units (-59.90 percent) last month, even as the overall sub-segment registered a 15.63 percent growth, to 67,210 units.

Clearly, buyers of products such as the Hyundai Venue (diesel/petrol: 2,029/8,292) and Ford EcoSport (2,087/1,626) are increasingly opting for petrol powertrains, given the feature-rich packages on offer; and from the looks of it, the complete exit of the segment king, Maruti Vitara Brezza, from diesel in the BS6 regime isn’t helping diesel vehicles’ cause either. The Brezza – which saw 11,613 units of its diesel version going home to buyers in February last year – recorded a 180-degree shift, with 6,848 units getting dispatched last month, when the crossover was launched in an all-new petrol-only avatar at the 2020 Auto Expo.

Petrol panache and pocket-friendlier prices of petrol cars

When it comes to passenger cars, this sub-category within PVs also recorded an 85 percent drop in sale of diesel variants, to just 3,816 units last month (February 2019: 25,566). While UVs are typically linked with diesel-engine power, passenger cars that range from mass-market hatchbacks to midsize C-segment sedans are usually preferred with petrol engines for their refinement and cheaper price tags.

As a result, sales of petrol-powered passenger cars could only register a nominal 4.56 percent increase in February, with sales totalling 1,52,167 units (1,45,533) as compared to the dramatic 200 percent jump in sale of petrol UVs.

Models such as the Honda City saw a 60.47 percent YoY decline in diesel-variant sales to 2,347 units (February 2019: 5,938); the Hyundai Verna dropped 50.42 percent to 9,003 units (18,159) and the Maruti Suzuki Ciaz registered a 64.53 percent decline in its diesel variant as well, to 3,374 units (9,513), clearly indicative of fast-changing buyer preferences.

That's not all. Mass-market diesel-engine favourites, including Maruti’s bestselling Dzire and Swift siblings, also dropped 40 percent and 55 percent to 67,127 units (1,11,090) and 24,659 units (54,670) respectively.

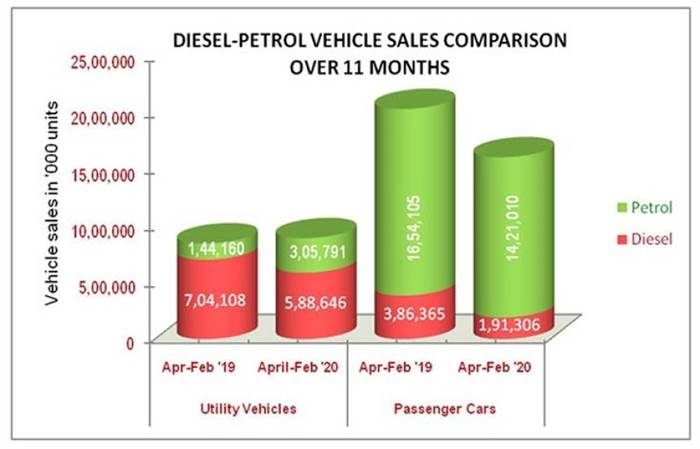

Petrol shows its power over 11 months in FY2020

The consumer shift to petrol power has been happening over the past two years but it is in the recent past that this pace has picked up, something that OEMs have learned too.

In the first 11 months of the ongoing fiscal year 2020 (from April 2019 to February 2020) diesel-powered passenger cars have dropped from contributing 19 percent to 12 percent of total PV sales, which also have slid sharply by 50 percent to 1,91,306 units (April 2018-February 2019: 3,86,365), proof enough of the reduced market size for passenger cars in favour of UVs. However, Petrol carmakers must be rubbing their hands with glee as sales have grown from 81 percent to 88 percent, with overall sales touching 14,21,010 units (April 2018-February 2019: 16,54,105).

As the country shifts to stricter BS6 norms from April 1 – which mandates a substantial 82 percent reduction in PM2.5 emitted from diesel, and a corresponding 68 percent reduction in NOx – the future of diesel vehicles in India looks blurred. A fair number of OEMs, including PV market leader Maruti Suzuki, are diving out from diesel, at least for the initial phase of Bharat Stage 6 implementation. Nonetheless, Korean carmakers Kia and Hyundai remain bullish on diesel-powered products, keen to play when the big cat is away. But will the torquey monsters make gains in the face of renewed and greener petrol power? Or will both fuels see a new contender for glory in the form of new mobility technologies like electric powertrains? Watch this space.

Comments

Member Login

Personal Details

No comments yet. Be the first to comment.