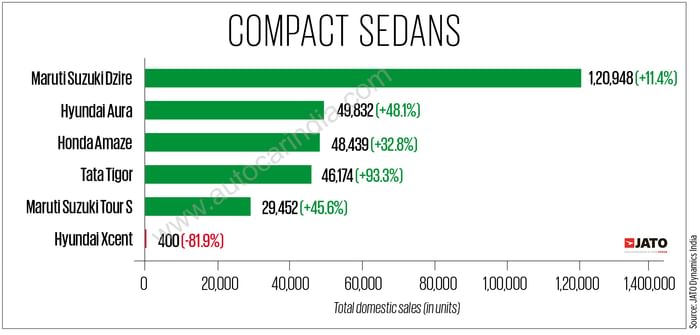

Compact sedans in India seem to replicate the fortunes of the compact utility vehicle segment – when compared to other sedan body styles – in terms of leading the market. In the 16-model sedan segment, cumulative sales of six compact sedans in FY2023 accounted for the bulk (2,95,245 units) or 73 percent of the overall 4,07,676 units. What’s more, all but one compact sedan registered double-digit sales growth.

Dzire accounts for 41 percent of compact sedan market

As in FY2022, the Maruti Dzire remains the top-draw sedan with 1,20,948 units, up 11 percent over year-ago sales of 1,08,564 units, thereby accounting for 41 percent of this category’s sales. Available with petrol and CNG fuel options, the Dzire is the sole product in the sedan segment to register six-figure sales, and that’s excluding the fleet-only Dzire Tour S, which sold 29,452 units. This places it fifth on the list, and it has bettered its FY2022 number by 45 percent. It was also the 10th bestselling passenger vehicle in FY2023 and the sole sedan in the chart-toppers list which includes four hatchbacks, four SUVs and one van.

Hyundai Aura sales FY2023

Taking second position is the Hyundai Aura, with 49,832 units, and it has recorded a strong 48 percent growth, improving upon its third rank in FY2022. This competent and well-rounded compact sedan with multiple powertrain options and a feature-rich, comfortable cabin continues to witness sustained customer demand.

Honda Amaze sales FY2023

Just 1,393 units behind the Aura is the Honda Amaze with 48,439 units, up 33 percent. The Honda Amaze was available with both petrol and diesel engine options, before the latter was discontinued due to RDE norms. Interestingly, the Amaze sees a strong percentage of its sales come from Tier 2 and 3 towns.

Tata Tigor sales FY2023

The Tata Tigor is available in petrol, CNG and electric guise, and clocked sales of 46,174 units, which translates to a strong 93 percent growth (FY2022: 23,889 units). The company is clearly benefitting from growing demand for the fleet-only X-Pres T, the electric version of the Tigor.

Midsize sedan sales FY2023

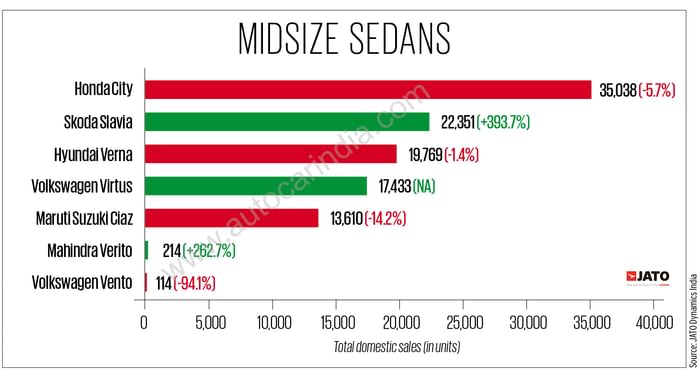

The midsize sedan market, with cumulative sales of 1,08,529 units and 29 percent YoY growth, contributed 27 percent to the total sedan category. Though the Honda City, with 35,038 units, topped in terms of volume, its numbers marked a 5.7 percent decline over FY2022. Now in its fifth generation, the City is available with petrol and strong hybrid powertrain options. Having ditched the diesel powertrain, the City rivals other petrol-only midsize sedans like the Skoda Slavia, Volkswagen Virtus, Hyundai Verna and the Maruti Ciaz.

Skoda Slavia sales FY2023

The Skoda Slavia is clearly the new challenger in this segment. With 22,351 units sold in FY2023, the Slavia recorded a 394 percent increase in sales albeit on a low year-ago 4,527 units. The Slavia shares a lot of its parts with the Kushaq SUV, including the pair of TSI turbo-petrol engines. Larger than most of its rivals, it feels well-built, is big on interior space and offers exceptional ride quality.

Hyundai Verna sales FY2023

Hyundai’s Verna sedan – ranked third with 19,769 units – was down marginally by 1.4 percent (FY2022: 20,052 units). This should improve in FY2024 as the carmaker has launched the new sixth-generation Verna in end-March 2023, at an introductory price of Rs 10.90 lakh. The latest Verna comes with four petrol-only powertrain options and Level-2 ADAS with 60 active and passive safety features. Hyundai is bullish about doubling sales this fiscal and dethroning the City.

Volkswagen Virtus sales FY2023

In fourth position in the midsize sedan rankings is the Volkswagen Virtus with 19,769 units sold in the last 10 months of FY2023. Launched in June 2022, the Virtus is the replacement for the long-standing Vento, which had a 12-year production run. With a larger footprint, more features and two TSI turbo-petrol powertrains, the Volkswagen Virtus is the sister car to the Skoda Slavia with a slightly higher price tag.

Maruti Suzuki Ciaz sales FY2023

If there is concern for Maruti Suzuki, other than the slowing sales of its budget hatchbacks, then it is the Ciaz sedan. Demand for the Ciaz, sold exclusively via the Nexa channel, has dropped 14 percent to 13,610 units in FY2023. Once a popular model, the Ciaz has received an update in terms of styling, more features and a more powerful mild-hybrid petrol engine. But that doesn’t seem to be enough in the face of newer, dynamic competition.

Three’s premium company

The premium sedan category, comprising the Skoda Superb, Skoda Octavia and Toyota Camry, accounted for 3,902 units or less than one percent of the total sedan segment sales in FY2023. That’s understandable when two of the three models have seen sales declines. The Skoda Superb (1,599 units) was down 4 percent and the Skoda Octavia (1,374 units) was down 28 percent year on year. The Toyota Camry was the sole product here in positive territory – 989 units, up 19 percent on FY2022’s 831 units.

Also see:

Mercedes Benz retains top spot as luxury car manufacturer

10 best selling cars in FY2023; Wagon R tops the charts

Tata Nexon tops SUV charts, Maruti Eeco bestselling MPV in FY2023

.jpg?w=234&h=156&q=90&c=1)

Comments

Member Login

Personal Details

No comments yet. Be the first to comment.