Maruti Suzuki may have lost the first-mover advantage in the EV race, but it’s taking the lead with hybrids, which, according to the company, will account for 25 percent of the company’s sales by 2031. Other automakers, however, are sceptical about hybrids, which they see as a transitionary technology to full electrification and not worth investing in. Besides, with no tax incentives given by the government to offset the high cost of a complex hybrid powertrain, hybrid cars are inherently expensive and hence difficult to price competitively. Maruti Suzuki thinks otherwise. India’s No. 1 automaker is betting on the comparatively under-utilised series hybrid tech instead of the more prevalent series-parallel system as a cheaper and more cost-effective solution to make hybrids affordable.

Why hybrids

India’s automotive market appears poised to stand as the last big bastion for internal combustion, with the government refraining from stipulating an end date for the combustion engine, the way Europe and other countries have. But unlike various carmakers who are betting only on EVs as the powertrain of the future, Maruti Suzuki has hedged its bets with a multi-fuel and powertrain strategy, which includes CNG, biofuels and hybrids.

Despite hybrids not enjoying the same level of attention as EVs and being dismissed as a technology whose time has gone, consumer preferences tell a different story. Hybrids consistently outsell EVs despite taxation policies heavily favouring the latter – hybrids face a steep 43 percent GST compared to the mere 5 percent for EVs – and despite a larger variety of electric models available to buyers. Currently, there are over a dozen EVs for sale in contrast to the limited selection of five strong hybrids.

Hybrid sales

Whilst Honda did bring a strong hybrid to the mass market with the City hybrid, it was a half-hearted attempt with no plans to localise the costly components. As a result, the City hybrid with ADAS features bundled in (which buyers have to take) is completely overpriced, costing Rs 2.7 lakh-4.2 lakh over the top-end non-hybrid version. The hybrid’s production is thus just 600 to 800 units a month.

Ironically, Honda, a pioneer of hybrid tech, has done an about-turn with its decision to not give the Elevate SUV a hybrid powertrain, but to develop an all-electric version, due in 2026, instead. Honda’s timing couldn’t have been worse. And Maruti Suzuki’s and Toyota’s timing couldn’t have been better – both Japanese partners have democratised hybrids with the launch of the Grand Vitara and Urban Cruiser Hyryder, which are smartly priced. These hybrids have turned out to be the new diesel, costing within reach and crucially, without the looming uncertainty of potential bans or restrictions in the future.

Hybrid plans

With Maruti Suzuki’s hybrid bet paying off with the Grand Vitara, the company has doubled down on its efforts to dramatically expand its hybrid portfolio. In mid-2025, Maruti Suzuki will launch an extended or three-row version of the Grand Vitara (code: Y17) as will Toyota of the Hyryder. Both SUVs will come with a strong-hybrid variant using the same Toyota 1.5-litre, three-cylinder powertrain. Maruti Suzuki expects to sell around 2,00,000 units of the Y17 in the first full year of production, of which 45,000 units could be the hybrid variant alone. But for hybridising its mass-market models like the Fronx, Swift, Dzire and Baleno, why is the company not using the same Toyota series-parallel system?

The series choice

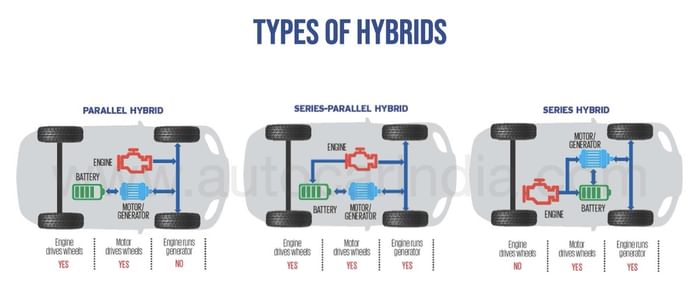

Hybrids can broadly be classified into three categories: series, parallel and series-parallel. In a series hybrid, the engine serves as a generator only, thus instead of directly powering the wheels, it only produces electricity to power a battery and motor that, in turn, drives the wheels. The advantage here is lower costs as the system is relatively simple and the engine does not require a full-range gearbox. Furthermore, since the engine does not take on direct driving loads, it’s most often running in the prime efficiency rev range. Thus, fuel economy gets a huge bump up and, as we reported earlier, Maruti is targeting a figure in the 40kpl mark.

Of course, with an engine and motor on board, the question arises, why not allow both to power the wheels? That’s where the parallel and series-parallel systems come in. In the former, the engine powers the wheels via a gearbox – adds costs though – and both engine and motor power the wheels together and/or independently, however, the engine does not go into a charging-only mode. When this also happens, it’s called a series-parallel system as the engine and motor can function in both a series and parallel manner. The system, while combining the benefits of the two, also raises costs due to added components like a power split device needed for this to work.

Thus, for the mass segment where costs are a prime concern, Maruti Suzuki has cleverly chosen to opt for the series hybrid system. Though Maruti Suzuki and Toyota have plans to localise the electric motor and LTO battery cells (at TDSG, a joint venture between Toshiba Corporation, Denso Corporation and Suzuki Motor Corporation), a hybrid powertrain – which includes an IC engine, electric motor and batteries – is inherently expensive. And a 43 percent GST on top of that doesn’t help. Plus, there’s a royalty Maruti Suzuki has to pay Toyota to use its famed series-parallel hybrid technology, which seamlessly switches from ICE power to electric power.

According to industry sources, Maruti Suzuki and Toyota explored a more cost-effective parallel hybrid powertrain (code: S1 Kei) but shelved the project as it could not meet the cost targets. Both companies took another stab at the segment with a newer generation hybrid system, with components optimised to save costs, but this project too (code: S1 2 Kei) wasn’t proving financially viable and plans to develop a mass-market parallel hybrid system were altogether dropped. Sources say that Toyota was simply unable to drive down the costs of its series-parallel hybrid tech beyond a point and hence called it quits. That spurred Maruti Suzuki to look at an alternate solution and delve into a series hybrid system. Just like it had democratised automatic transmission by reviving the unsophisticated but affordable AMT technology for India, Maruti Suzuki hopes to do the same with its series hybrids, which could be the AMT equivalent in the hybrid market.

With technical inputs from Mayank Dhingra and Sergius Barretto.